Partner with Us

eBullion® combines cutting-edge technology with expertise in precious metals management, strong governance around customers’ assets (funds and metal), and a team motivated in providing solely an awareness-based savings option to customers. Product Overview

In India, where precious metal savings has existed since ancient times, partnering with eBullion for precious metals is a strategic choice to enhance your digital journeys and expand your market reach. eBullion® is purpose-built for integration with your systems over the internet and enables you to create customized journeys (SIP, corporate buying, gaming points, cross-product redemption and unlock new avenues for enhancing customer motivation and revenue streams. We can help you curate journeys for different communities whether they are customers, employees, or social outreach.

Moreover, eBullion’s commitment to zero comprehensive risk and asset verifiability for your customer and end-to-end precious metal management ensures the utmost security and peace of mind for you and your customers.

Product Overview

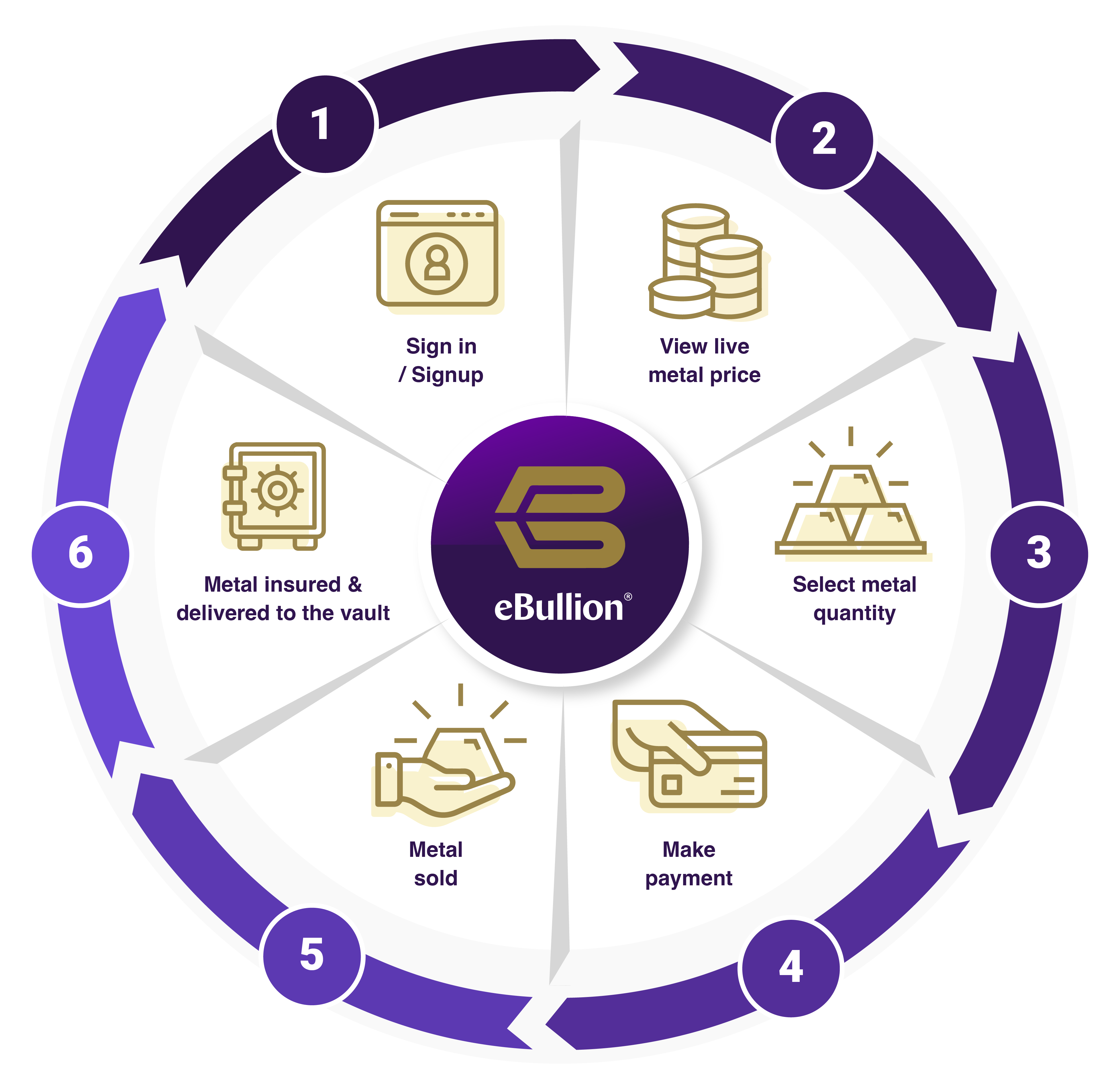

Buy eBullion

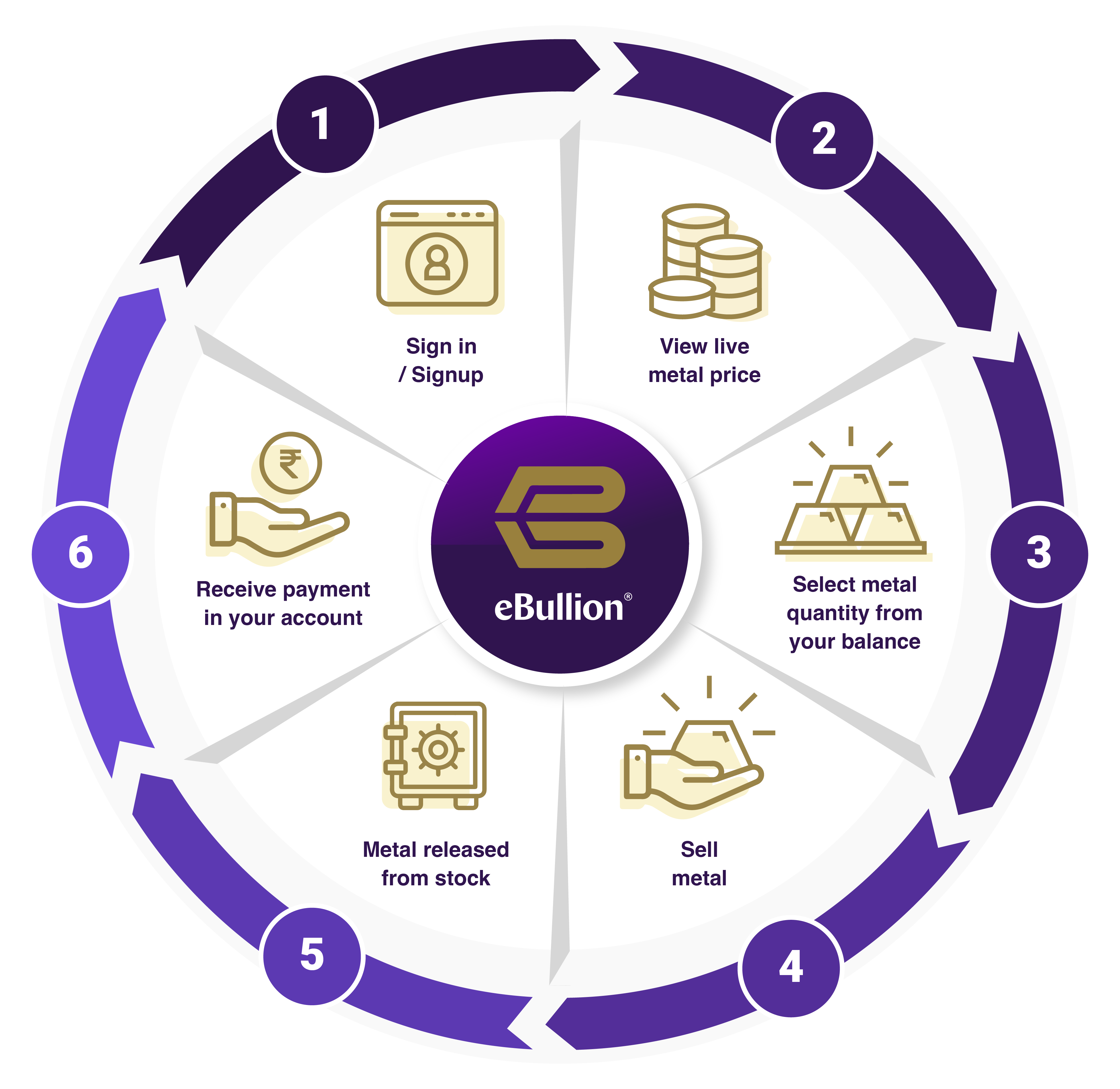

Sell eBullion

Our commitment to you as your partner

We have designed an ‘always available’ application

Our experienced experts ensure a seamless and efficient integration process.

We provide substantive documentation of our REST API end-points for each user journey.

You have access to plug-and-play precious metals management processes honed over many decades.

Our award-winning equity market-like settlement mechanism (We deposit metal in advance, and the Customer pays in funds) means that we receive your funds only when the independent third-party service operator has received and insured your metal in its vault with global insurers.

Follow equitable terms for D2C and partner customers for the similar offerings.

Our association with Hindustan Platinum enables us to source for 3 out of 4 metals certified for London Good Delivery – The international bullion standard in India itself, thus mitigating import-related market disruptions for metal sourcing.

Our operations are focused on risk mitigation of regulatory, financial and operational risks to protect the assets of our customers, including wind-down planning.